By Ken Altena, Billboard Loans LLC.

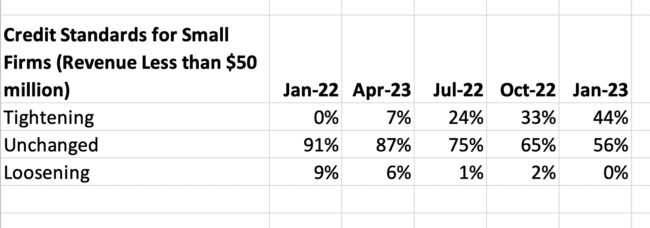

I track the Federal Reserve Senior Loan Officer Survey on Bank Lending Practices to determine if credit is tight or loose. Banks have been tightening their lending standards for small firms (revenue less than $50 million) for four consecutive quarters due to recession fears. 44% of the bank loan officers responding the the January 2023 survey reported their institution was tightening lending standards for small businesses. None of the banks were easing.

My take: I expect April will show an additional tightening in small firm lending standards. Tightening standards mean lower Debt/Cashflow covenants, higher Debt Service Coverage covenants and higher interest rates and loan fees when your out of home bank loan comes due. It’s important that you meet frequently with your bank during tight credit to keep you bank comfortable with your business. What’s familiar is often considered less risky. When was the last time you met with your banker?Now’s also a good time to reach out to a lender who specializes in the out of home industry. In times of tough credit many banks reduce or stop lending to out of home.

Ken Altena has 35 years as a lender to out of home companies. He is a partner in Billboard Loans, LLC. You can contact Ken at 206-910-1283 or by emailing [email protected].